1. Brief description

"RD Congo Investment Fund" is a venture capital company in the legal form of a public limited company, specialising in financing projects in the DRC and Africa. The head office of the fund is in Kinshasa and it will have an initial capital of 200 million $US, divided into shares between its shareholders.

a. The Board of Directors

The Board of Directors of the fund is composed of 18 members distributed as follows:

- 11 members from Grand Impex Trading Ltd, each with veto rights.

- 5 members from the Government of the DRC ;

- The Board appoints and dismisses key members of the fund's management team. It meets twice a year.

b. The Credit Committee

The Credit Committee is responsible for the fund's investment decision. In addition to the fund's Managing Director, it is composed of 8 members, including :

- 5 members of Grand Impex Trading Ltd ;

- 2 members of the Government of the DRC

- 1 member of civil society

This committee meets once a month to review applications for funding. Its investment decisions must be approved by the Board of Directors.

c. General Management

The staff in charge of the daily management of the fund will have to be quality personnel. This is why emphasis will be placed on recruiting human resources with proven experience, very often from private investment banks, project finance, private equity/venture capital.

The fund managers' remuneration will be modelled on international practices in the sector, a participation in the capital gains generated, and a defined minimum rate of return.

The management team will be responsible for monitoring investments. In particular, it will ensure that the capital invested is truly allocated to the needs presented by the promoters. As a basis for monitoring, the following can be retained:

- Application of the legal documents signed (shareholders' agreement, current account loan agreements, etc.).

- Organization of the Board of Directors and prerogatives

Joint organization of governance and reporting

The monitoring elements are: monthly and quarterly reports, the Board of Directors a strong interaction with the management. In addition, the management team will keep investors informed of any new investment and any significant developments concerning the companies financed.

d. The Supervisory Committee

The Supervisory Committee is the body responsible for monitoring and ensuring the quality of the fund's operation. It is responsible for ensuring compliance with

recommendations and the implementation of the Administration's directives. It includes several components, among others:

- The fund's compliance department;

- The auditor;

- The firm of Deloitte.

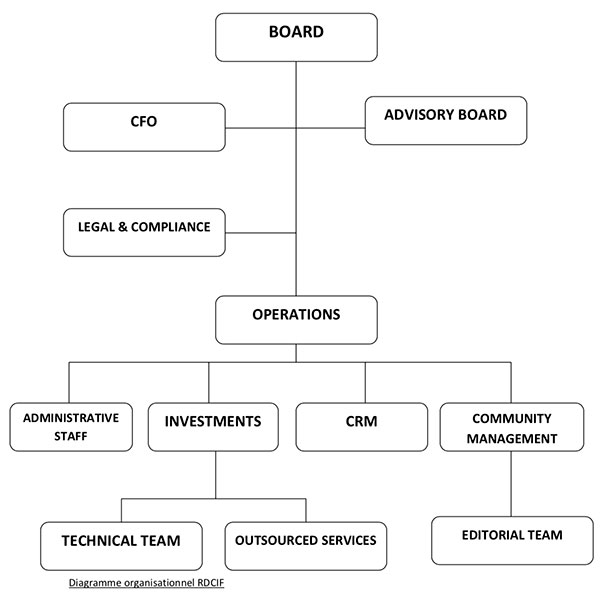

2. Organizational chart